|

|

-

Make sure you are in the "Klein Oak High School" account.

-

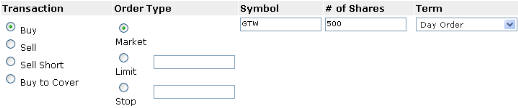

Enter the information for your trade. Here I'm buying 500 shares of Gateway.

For an explanation of what these different words mean, click here.

You have to indicate what type of transaction you're doing (for more on short selling, click here), what type of order you're placing, the stock trading symbol, the number of shares, and the term of the order.

"How do I know what stock to buy?"

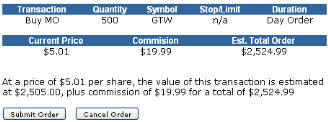

"How do I know how much to buy." - Click on "Preview Order."

- Verify your order and click on "Submit Order."

- It will take a few minutes for the order to be placed. To see the order in the meantime, you can click on "Open Trades" under "Trading." [Note that if you place an order during a time when the stock exchanges are closed, the order will not be placed until the market opens.

-

You must buy stock in at least five companies. Your portfolio must total at least $80,000. You can buy and sell stock - long and short, but you must always own (or have sold short) at least five stocks worth at least $80,000.

"How do I know what stock to buy?"

You don't! So don't worry too much about it!

The markets are very efficient. What this "efficient markets" hypothesis means is that it takes the stock market just a few seconds to fully absorb news that will impact the financial performance of a company and reflect that in the price of the stock.

So what chance do you have to know something that someone else doesn't know so that you can profit on a forthcoming change in the stock's price? Not much.

In fact the best estimate of the future price of a stock is the current price of that stock. When you pick a stock, whatever stock you pick, you have about a 50% chance of doing better than the market. By "better than the market" we mean that your chosen stock will outperform the market average. For example, if the market increases in value by 10% over a given period, and your stock increases 12%, it has outperformed the market.

Want some ideas about companies? Click here for "Stocks for Teens to Consider" from The Motley Fool.

Back to stock trading instructions.

"How do I know how much to buy."

You need some information about your company. You especially need to know how much a share of stock is selling for. Then you divide the amount you want to invest in that company by the stock price to find the number of shares you want to buy.

For example if I want to invest $10,000 in Gateway and it's trading at $5.01/ share, I want to buy $10,000 ÷ $5.01/share = 1,996 shares

You can look up stock information by entering the symbol here.

If you don't know the symbol, you can find it on the Investopedia site or use one of the sites listed below.

| MSN MoneyCentral | CBS Marketwatch | CNN Money |

| Reuters | Motley Fool |