|

|

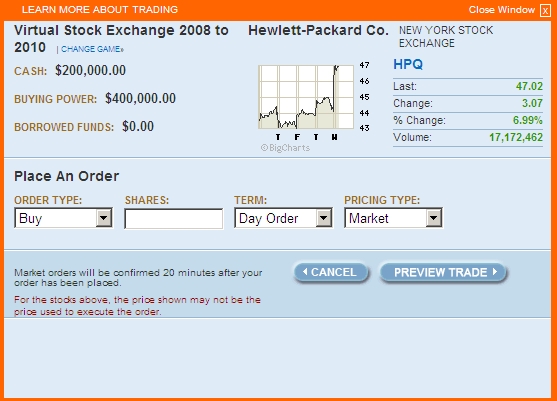

Order Type

Ordinarily we think of people buying stock, holding it for a while as it - one hopes! - appreciates in value and selling it for a "capital gain." And that's the way most trading works. So the "Buy" and "Sell" order types are pretty obvious.

But what if you think HP stock is going down instead of up? Obviously you don't want to buy it, but you could make some money off the downward move in stock price by borrowing some HP stock (with the promise to pay back the stock in the future), selling it now, waiting for the price to fall, then buying the stock at the reduced price in order to repay the borrowed stock. This process is called "short sale and cover." Thus the options of "Sell Short" and "Buy to Cover." So, to summarize:

- Buy - Choose this if you think the stock is going to go up in price and you don't currently own it.

- Sell - Choose this if you think the stock is going to go down in price and you do currently own it.

- Sell Short - Choose this if you think the stock is going to go down in price and you don't currently own it. You are borrowing and selling the stock.

- Buy to Cover - Choose this if you think the stock is going to go up in price and want to "cover your short position" (in other words, repay the stock you previously borrowed in order to sell short) before the price goes up.

Shares

Obviously you type in the number of shares you want to trade. How many is that? It depends upon how much of your portfolio you want invested in this company's stock. Remember you need to spend at least $80,000 in on the stocks of at least seven companies.

So if I want 1/7 of my portfolio to be HP stock I need to buy about $14, 286 worth. Dividing that by the stock price of $47.02 tells me that I need about 304 shares of HP stock.

You certainly do NOT have to have equal dollar amounts of each companies stock. I just offer the above for illustration purposes.

Term

This just determines if you want the order to end after today or to hang out there until it is executed or you cancel it. Ordinarily this won't make a difference because the order will be executed almost immediately. If you choose "limit" or "stop" under "pricing type," however, it may make a difference.

Pricing Type

Ordinarily you want to choose "Market" here. That just instructs your broker to buy or sell the stock at the best price he can in the current market. So the HP stock seen above would be purchased for $47.02 per share.

If instead I choose a "Limit" order and limit the price to $40.00 per share, then the order will not be executed until my broker can buy it for $40 per share. In other words, she will wait until the price falls to that level before executing the trade.

If I own the HP stock and I want to sell it if it hits $50, I would choose a "Sell" in combination wtih a "Limit" of $50.

"Stop" is short for "stop loss." So I might want to buy the HP stock at $47.02 and then enter a "Stop" sell for $40. Then my broker will sell the stock if it falls to $40 in order to limit the amount I can lose on the stock.